Have you ever wondered how much superannuation you will have and need in retirement? The answer is it depends on a range of factors, such as your lifestyle goals, whether you have paid off your mortgage, your financial situation, whether you live a relatively healthy lifestyle, your likely life expectancy, and so on.

How much will I spend in retirement?

According to the government’s MoneySmart website, the amount of money you will need when you retire depends on:

- Your costs in retirement – for example, paying off your mortgage, rent, renovations, travel and medical costs, and

- The lifestyle you want – for example, a modest versus a comfortable lifestyle (discussed below).

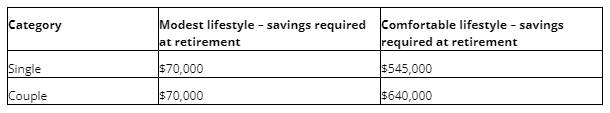

MoneySmart suggests that if you own your home, a general rule of thumb is that you’ll need two-thirds (67%) of your current income each year to maintain the same standard of living. The other option is to use the Retirement Standard from the Association of Superannuation Funds of Australia (ASFA) which estimates how much the average Australian would need to retire on. The Retirement Standard budget for individuals aged 65 to 84 that retire at age 65, who own their home (no mortgage), and are relatively healthy are as follows: There is a separate Retirement Standard budget for retirees aged 85 and over. This budget estimate provides a picture of how spending requirements change as people enter their late 80s and early 90s. Like the original standard, it also assumes that retirees own their own home. The budget estimates for this cohort of individuals is as follows:

There is a separate Retirement Standard budget for retirees aged 85 and over. This budget estimate provides a picture of how spending requirements change as people enter their late 80s and early 90s. Like the original standard, it also assumes that retirees own their own home. The budget estimates for this cohort of individuals is as follows:

Source: ASFA Retirement Standard, March quarter 2022 (for both tables) ASFA’s modest standard estimates how much money is needed for the basics, which is mostly met by the Age Pension. ASFA’s ‘comfortable’ standard estimates how much money is needed for retirees to be involved in a range of leisure activities and to have a good standard of living including:

- Private health insurance

- A reasonable car

- Household goods, and

- Holidays

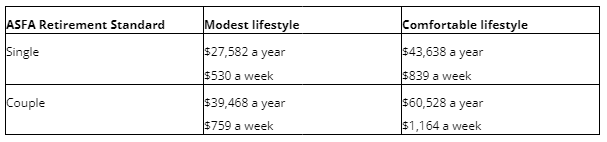

How much superannuation will I need? ASFA estimates that the lump sum needed at retirement depends on a range of factors, with one major factor being your standard of living. As a rough estimate, the superannuation balances required to achieve a modest and comfortable retirement are as follows:

The lump sums needed for a modest lifestyle are relatively low as a modest lifestyle covers the basics and is mostly met by the Age Pension. On the other hand, the lump sums needed at retirement to support a comfortable lifestyle assumes the retiree/s will draw down all their capital and receive a part Age Pension. How much will I have? Despite the projected budgets and superannuation balances that may be needed in retirement, you can estimate how much superannuation you’ll have when you retire by using the MoneySmart ‘retirement planner’. This tool can help you estimate:

- How much money you’ll have to spend each year once you retire

- How fees, investment options and contributions will affect your retirement income, and

- How to test out different scenarios and work out how to grow your superannuation.

You can access the MoneySmart retirement planner by:

- Visiting moneysmart.gov.au/retirement-income/retirement-planner (or search for ‘retirement planner’ on the MoneySmart website), and

- Start entering your personal details in the retirement planner calculator to work out how much superannuation you’ll have when you retire.

Reduce the gap and build your superannuation You may find that the amount of superannuation you’ll have when you retire may not be enough to fund the lifestyle you want in retirement. But don’t worry too much, as it’s never too late to build up your superannuation to boost your retirement savings. There are a number of things you can do that can increase your superannuation over time, such as:

- Make extra contributions to grow your superannuation

- Change your investment option within your superannuation account, and

- Consolidate your superannuation funds into one account so you pay less fees.

Need Help?

Planning for retirement can be complicated. Contact your Stratogen accountant today for a chat about how we can help you achieve your financial goals in order to have a better financial future in retirement.

At Stratogen Accounting, we offer the full range of services expected of a leading edge accounting firm. From accounting, taxation and bookkeeping to estate planning, business planning, restructuring and systemising, through to assisting our clients obtain finance – both business and private. Based in Noosa, on the Queensland Sunshine Coast, we service clients around Australia.